Transform Lives Through Payroll Giving

Payroll Giving is a simple and tax-efficient way to make your donations go further. Because your donation is taken from your salary before tax, giving £10 a month only costs:

- £8 for basic rate taxpayers

- £6 for higher rate taxpayers

- £5.50 for additional rate taxpayers

This makes Payroll Giving more tax-efficient than Gift Aid for higher-rate taxpayers! You can choose any amount to give – there’s no minimum or maximum. If your employer offers Payroll Giving, setup is easy through your HR team. If they don’t, we can help you encourage them to start a scheme.

How Your Donation Makes a Difference

- £5 - Helps buy sensory items for neurodivergent children

- £10 - Supports a disabled child's Short Break sessions

- £20 - Helps to fund a disabled child's first electric wheelchair

- £50 - Contributes towards a child's Autism Assessment

How to Set Up Payroll Giving

- Check with Your Employer – Ask if they offer Payroll Giving. If they do, they’ll arrange the donation through your salary.

- Choose Your Donation Amount – Decide how much you’d like to give each month. Your donation is taken before tax, meaning you give more at no extra cost.

- Your Donation Supports Caudwell Children – The funds come directly to us, helping to provide life-changing support for children and families.

What If My Employer Doesn’t Offer Payroll Giving?

If your employer hasn’t set up a Payroll Giving scheme, you can encourage them to start one by registering with an approved Payroll Giving agency – like us!

Need support? We’re here to guide you through the process and help get your workplace on board.

Changing jobs? Payroll Giving doesn’t transfer automatically to a new employer, so you’ll need to set it up again with your new company. We can assist you in making the switch seamless.

Start making a difference today! For any questions check our FAQs, call 01782 433 750 , email partnerships@caudwellchildren.com or fill out our online form for support.

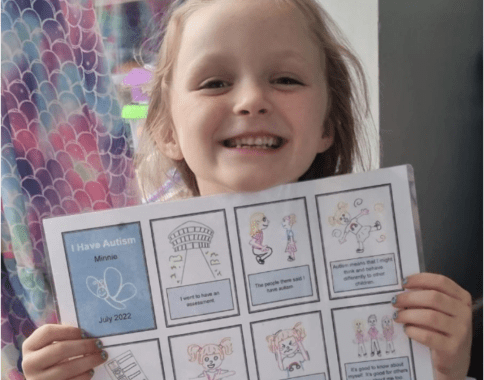

Real Stories, Real Impact

Meet Minnie

Meet Ellie

Meet William

Payroll Giving FAQs

Payroll Giving allows employees to donate to Caudwell Children directly from their salary before tax is deducted, making it a tax-efficient way to give. Employers facilitate the deductions through a Payroll Giving scheme.

Any employee who is paid through PAYE (Pay As You Earn) can participate in Payroll Giving, provided their employer has a scheme in place.

Yes, as long as they are paid through PAYE, part-time and flexible contract employees can participate.

Payroll Giving boosts employee engagement, demonstrates corporate social responsibility, and provides a simple, tax-effective way for staff to support a meaningful cause. It also enhances your company’s reputation as a socially responsible employer.

There is no minimum or maximum amount. Employees can choose how much they want to donate, and it will be deducted from their gross salary.

Donations are taken from gross pay, meaning they are given before tax is deducted, providing immediate tax relief. For example, a £10 donation only costs a basic rate taxpayer £8.

Setting up a scheme is easy – simply register with an approved Payroll Giving agency, like us, integrate it into your payroll system, and promote it to employees. Our team can provide guidance and materials to support the process.

There is no direct cost to employers, though some Payroll Giving agencies may charge a small administration fee. Many businesses choose to cover this to ensure employees’ full donations go to charity.

Yes, employees can change the amount or cancel their donations at any time by informing their employer or Payroll Giving agency.

We can provide tailored promotional materials, workplace presentations, and impact stories to engage employees. Some businesses also offer matching schemes to maximise contributions and encourage participation.

Payroll Giving donations are deducted before tax, while Gift Aid donations are made after tax, and the charity claims back the tax. Payroll Giving is processed through the employer’s payroll, while Gift Aid requires the donor to complete a declaration.

Yes, offering Payroll Giving can enhance your corporate social responsibility (CSR) credentials and help build stronger relationships with charities and the community.

Matched Giving is when an employer matches employees’ donations, doubling the impact. This is an excellent way to motivate employees to participate.

Donations are usually processed monthly and passed to the chosen charities promptly after deduction.

Corporate Partnerships Team

Our Corporate Partnerships Team are on hand to help with any questions or guidance you need to support you, call 01782 433 650 or email partnerships@caudwellchildren.com

)

)

)

)

)